Malaysia 1H 2021 auto sales – state of affairs at half time: Perodua share below 40%, Mitsu biggest gainer

I can imagine that the past year and a half has been a topsy-turvy time for restaurants. Imagine dealing with the various and sudden movement control order (MCO) version changes, and adapting your kitchen inventory to the expected output. There’s also staff rostering, a balance between taking care of your people and efficiency. That’s what I can think of as an outsider (there are more issues, for sure), before even factoring in the drop in sales from dine-in restrictions.

Now imagine a carmaker with a factory. A vehicle requires so much more parts than nasi lemak, and there are so many suppliers (and suppliers of the suppliers) in the picture. Multiply that with a couple of models and thousands of workers. When the light is green, produce too little and you risk not being able to take advantage of pent-up demand, make too much and you’ll risk overstock.

To further complicate the situation for carmakers, there’s an ongoing sales tax incentive influencing consumer decision. It’s a temporary boost, but no one truly knows when it’s going to end – SST exemption has been extended twice already, and the first extension was announced just two days before the deadline! At present, the end date is December 31 2021, but the Malaysian Automotive Association (MAA) is asking for another six months.

Factor in all the above and the usual ups and downs of buying trends is as good as useless for sales and production planning. As if the challenge isn’t big enough, there’s the global issue of microchip shortage to contend with. Some are more affected than others, and market leader Perodua has put its hand up to acknowledge the problem. We know that there are other local factories having chip supply issues, too.

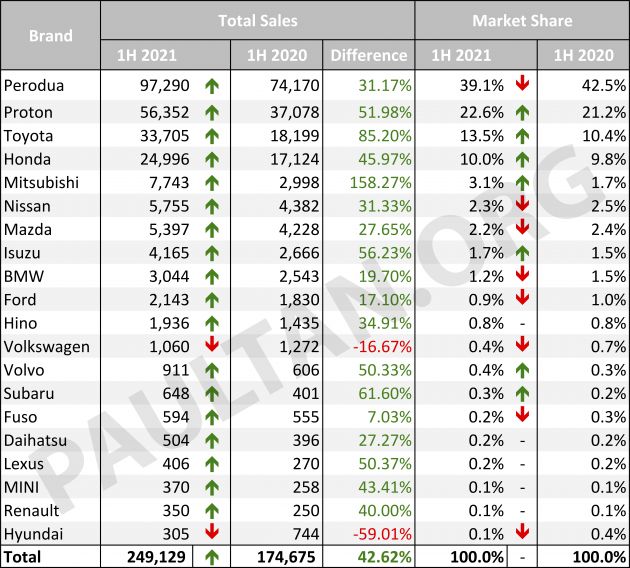

That lengthy intro is a background for the 1H 2021 auto sales that we’re sharing here. The first half of 2021 saw carmakers sell 249,129 units in Malaysia, which is 42.62% higher than the 174,675 units sold in the same period last year. That seems super healthy at a glance, but bear in mind that 1H 2020 was an extremely low base due to the arrival of Covid-19 and the first MCO.

To compare with pre-pandemic days, in 1H 2019, 296,317 units were sold, which means we’re just over 47k down over peacetime sales. That’s not disastrous, and surely much of it has to do with the sales tax exemption. As MAA president Datuk Aishah Ahmad says, “orders are coming in, people still want to buy”.

With that said, let’s see how the brands did in the first half. The top four spots are unchanged, and the order is Perodua, Proton, Toyota and Honda. Sales for all four are up (in fact, year-on-year sales are up across the board except at Volkswagen and Hyundai), but there’s some movement in market share.

Perodua’s slice of the pie has slipped below the 40% mark (39.1%), which was breached for the first time (full year) in 2019. But there’s half a year to go, and P2’s 240k sales target for 2021 remains unchanged.

Toyota’s market share jump is the biggest in league, up 3.1% from 10.4% to 13.5% y-o-y. The big T’s lead over Honda in both sales and share is very healthy at half time, and the company is on track to fulfil its stated mission for 2021 – which is to regain the No.1 non-national spot that Honda has occupied since 2015 – unless something dramatic happens.

The standout brand in the table is Mitsubishi. Sitting pretty just below the big four at fifth, Mitsubishi Motors Malaysia (MMM) sold 7,743 units in the first six months of 2021, a mammoth 158% higher year-on-year. This spurt gives the brand a 3.1% market share and a position ahead of Nissan (5,755) and Mazda (5,397), which are the traditional “best of the rest” occupiers of the fifth and sixth spots.

Powering MMM’s 2021 sales is the Pekan-assembled Xpander seven-seater, which was launched towards the end of 2020. The bread and butter of the brand also received a new Triton Athlete flagship variant in April. Momentum has been building for MMM – best ever sales in a financial year’s quarter in Q1, monthly record in April – but the challenge now is to end the year as the No.3 non-national brand behind T&H.

It’s rather quiet in the premium segment – with Mercedes-Benz no longer reporting sales data to the MAA, we don’t know how the three-pointed star is doing next to arch-rival BMW, which by the way sold 3,044 units, 19.7% higher y-o-y. Interestingly, even though Volvo sales are not yet in four figures (911), it showed 50% y-o-y growth for an 0.4% market share (BMW 1.5%). Long way still for the Geely-owned brand to reach the sales level of the German stalwarts, but it’s one to watch.

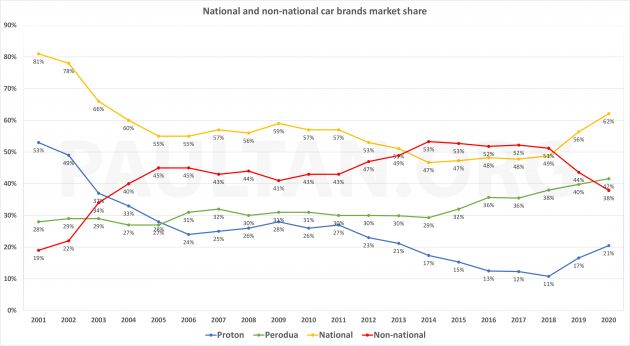

Earlier this year, we pointed out that national brands had 62% share of the Malaysian market in 2020, the highest combined score for Perodua and Proton since 2003. Conversely, non-national makes accounted for 38% of sales last year, some way down from a high of 53% in 2014, when foreign brands overtook P1-P2 for the first time ever.

In this chaotic first six months of the year, the balance is pretty much the same, although there’s a slight decline for the national brand share, to 61.7%. Perodua’s slight decline in share is the reason behind this, but Proton is maintaining its momentum. Anyway, with the base segments covered and new SUV models turning heads in higher price points, expect this trend to continue in favour of the local brands.

Click on these links for more on the ups (Perodua) and downs (Proton, which is now back from the dead, so to speak) of the national brands over the past decade, and the unlikely reign of Honda as the top foreign make in Malaysia. On how the entire automotive ecosystem is hurting from the lockdown, especially the dealership frontliners, read more here.

The post Malaysia 1H 2021 auto sales – state of affairs at half time: Perodua share below 40%, Mitsu biggest gainer appeared first on Paul Tan's Automotive News.

from Paul Tan's Automotive News

Read The Rest:paultan...

Post a Comment