Malaysian vehicle sales data for Jan 2021 by brand – Perodua’s share above 50%, national brands at 70%

The Malaysian Automotive Association (MAA) has released vehicle sales data for the month of January 2021, which saw a total of 32,829 units registered last month. That’s 52.3% less than the 68,836 units sold in December 2020. While a big drop after the year end party is to be expected, Jan 2021 sales were also 23.5% lower than the corresponding month in 2020.

The MAA attributed last month’s low sales to two factors. One is low footfall in showrooms due to the reimplementation of the movement control order (MCO) on January 13. While car showrooms were allowed to open, people weren’t out and about as usual and were confined to their own areas.

Another factor was that many brought forward their car purchase to December 2020 ahead of the anticipated end to sales tax exemption on December 31 (which, at the final hour, was extended to June 30, 2021). This resulted in lower stock levels in January for some brands. The association also cited the shutdown of some parts suppliers’ operations due to Covid-19, which left some carmakers short on components.

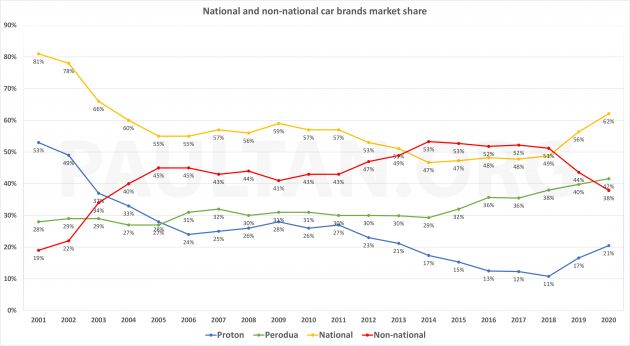

Half of what was left of January’s sales was lapped up by Perodua, which 16,887 units was good for 51.4% market share. That’s way more than the new normal for the market leader, which is now over 40%. New number two Proton sold less than half its Dec 2020 total, and its below 6k figure translates to 18.2% share. With that, the national makes accounted for nearly 70% (69.6%) of January 2021 sales. It has not been so high for a long time, solidifying the trend in favour of the local brands.

Talking about trends, Malaysia’s non-national segment has bucked global trends for some time now, with Honda ahead of Toyota as the top-selling foreign make since 2015, when it overtook Toyota for the first time ever. Toyota – the world’s top-selling carmaker – has stated its aim to reclaim the No.1 non-national spot, and it’s off to a good start here.

The big T’s January sales were well ahead of Honda’s, even without the help of commercial vehicles (which Honda has never had) – 2,450 vs 1,457 units. In the sea of red, another surprise is Mitsubishi at fifth; with strong Xpander sales in the first month of 2021, it has jumped Nissan and Mazda (MMC was seventh overall in 2020) at this very early stage.

By the way, BMW Group Malaysia (BMW and MINI) will only be releasing quarterly reports, while premium segment arch-rival Mercedes-Benz has completely stopped sharing sales data. BMW has claimed leadership of the premium segment, with 2020 sales ending Mercedes-Benz’s run from 2015 to 2019 as Malaysia’s top-selling premium brand.

Just like the football league table, we shouldn’t be reading too much into the car sales table in the first month – after a big party, some wake up earlier than others, and there are plenty of stock variables at play (some have leftovers, some have empty shelves). There are also new models to come, and the success of the reinforcements will determine where the brands end up at the end of the year.

But as pointed out in our review of auto sales over the past decade, there are some clear trends to be seen. A rejuvenated Proton is now doing its part to boost up the total share of national makes, something that the consistent Perodua has been doing alone for some time. Combined, they took up 62% share of Malaysian market last year, the highest since 2003.

Conversely, non-national brands have been having market share of above 50% from 2014 to 2018, but the rise of Proton has directly affected them – 2020’s 38% share is the lowest level for foreign makes since 2003 (34%). With the Perodua Ativa coming out soon and the Proton X50 having its first full year of sales in 2021, expect this trend to persist. Both P1 and P2 SUVs are priced and specced to entice those who would naturally go for a Honda or Toyota, so it’s a big battle ahead.

Of what’s left of the non-national pie, it’s set to be a two-speed non-national race – Honda vs Toyota for third/fourth, and Nissan vs Mazda for fifth/sixth. The clear space between Honda and Toyota has evaporated (Honda ended 2020 ahead, but just), and the same goes for Nissan vs Mazda. The season has just started, and it’s all to play for.

The post Malaysian vehicle sales data for Jan 2021 by brand – Perodua’s share above 50%, national brands at 70% appeared first on Paul Tan's Automotive News.

from Paul Tan's Automotive News

Read The Rest:paultan...

Post a Comment